Mengisi Waktu Luang Melalui Bermain Judi Online

February 21, 2023Dominate Your Market With Search Engine Optimization

February 21, 2023Content

Businesses may issue recurring invoices when the customer is obligated to make multiple payments. An example is recurring invoices for monthly software subscription payments. Since POs are legally binding, they do not require a separate contract. That means that when a purchase order is accepted by the vendor, it has all the legal weight of a contract.

- Purchase orders are important for any buyer who wants to get services or goods from a supplier, vendor, or seller.

- The supplier will then send a bill or sales invoice for the purchased items.

- When Dan’s accountant receives it, he references that number and can see in the system that delivery was made.

- Use special software to keep your purchase order system tidy, as with clear inventory visibility; you will be able to determine when to replenish the stock and streamline the workflow.

- You won’t have to make a photocopy of the documents, which might add up quickly if you’re sending out a lot of POs and invoices every day.

- Purchase orders may seem like a tedious document to include for every project or purchase.

Because a purchase order is legally binding, vendors are able to fulfill orders before they receive payment. Invoices usually go hand in hand with purchase orders, as both documents specify the exact amount owed to the seller. Invoices are often referred to as “statements,” “sales invoices,” or “bills.” An invoice is always created in response to the respective PO, even if the order was settled informally. In other words, purchase orders go first, then invoices come later. An invoice should include the original purchase order number for reference. This will show the client’s accounting department that this transaction was already budgeted for and approved previously.

What Is an Invoice?

How to report and analyze indirect spend to identify savings opportunities. Where the best opportunities for savings are in indirect spend. We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

What is the difference between an invoice and a purchase order brainly?

The creation of a purchase order is the first step in a business transaction, it is issued by the buyer and authorizes a seller to provide a product or service at a specified price. The invoice is a bill issued by the seller when that product has been delivered or the service has been completed.

A supplier will typically send an invoice to a buyer after they receive their requested goods . But a buyer will send a purchase order to a company or vendor to communicate https://kelleysbookkeeping.com/ their desire for a particular service or set of goods. For instance, a vendor might send an invoice to a buyer after they make a purchase of an agreed-upon order.

Embracing the Differences Between a Purchase Order and an Invoice

Since it’s pre-approved, no further approvals are required, and the invoice can be processed quickly. The only requirement in most cases is that the PO invoice details should match those on the purchase order. Based on the requirements, an employee in the procurement department submits a purchase requisition depending on the quotes they What Is The Difference Between Purchase Order And Invoice? receive from different vendors. As the name suggests, a non-PO invoice is one that doesn’t have a corresponding purchase order. Such invoices are also known as expense invoices, and usually indicate any indirect purchases made by a business. Owing to the nature of indirect procurement, non-PO invoices are generally not pre approved.

Purchase orders act as official agreements between the buyer and the seller, authorized by the management of both companies. If you have a purchase order with all the required information and confirmation, you might not need a separate contract. The information on a PO often includes the list of items that a buyer would like to purchase, quantities for each item, and agreed-upon prices. The benefits above are geared toward purchasers, but POs are also important documents for vendors—who use them for order fulfillment and payment processing. Invoice Email – How to Run Your Business More Easily Get paid on time for your product or service with the Finom invoice program. Save time with invoice templates and use a financial management program.

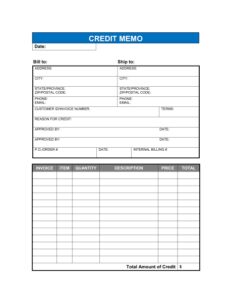

What details are included in an invoice

Some companies prefer to simply state “payment due upon receipt” to fast-track the payment process. While a deadline of 30 days might be appropriate, you might also wish to send a payment reminder to your clients before assessing any late fees. A purchase order is a vital part of the purchasing and procurement procedure for your business.

- Additional responsibility for the buyer to initiate a PO request and draft a formal PO document.

- A purchase order is such an important document in purchasing process due to many reasons.

- On the other hand, an invoice is delivered after the vendor has fulfilled their part of the obligation.

- For products, you’ll usually get paid at the time of the order.

Blanket orders are typically used between companies with a strong relationship and sometimes come with discounts or other incentives. The main difference between purchase order and invoice is that while a purchase order is just to order goods from the seller and thus it defines the selling terms. On the other hand, invoice is used to authorize sale, it is a confirmaton document.

Some companies have standard templates too, which they edit and send as PDFs. Purchase order details can be used to make budgeting decisions as they depict how much their requirements are. First, here’s a brief definition of both PO and non-PO invoices. Save your organization time and effort by automating the billing process, particularly when it comes to recurring billing.

This is very difficult to keep track of with a low volume, let alone a high one. It can quickly get overwhelming, and the risks for losing items or having errors is extremely high. Invoice template, manually producing numerous papers of this nature can be laborious and error-prone. Additionally, manual documents frequently become jumbled or, even worse, vanish, creating problems during disputes or audits. Besides some common details, Purchase orders and Invoices are two separate terms with many differences.